US Fed 'big cuts' interest rates by 0.5 percentage point to bring inflation closer to target, considers another 50 basis point cut later in the year.

The US Federal Reserve's (Fed) Federal Open Market Committee (FOMC) announced in an official statement that it will cut its benchmark interest rate by 0.5%. This is the first rate cut in nearly four years. The Fed raised rates from March 2022 through July of last year. It then left rates unchanged eight times in a row from September last year to the July meeting.

The Fomc Said, “Recent indicators suggest that economic activity is expanding at a solid pace. Job growth has slowed and the unemployment rate has risen but remains low. Inflation has moved closer to the Committee's 2 percent objective but remains somewhat elevated,” the statement said.

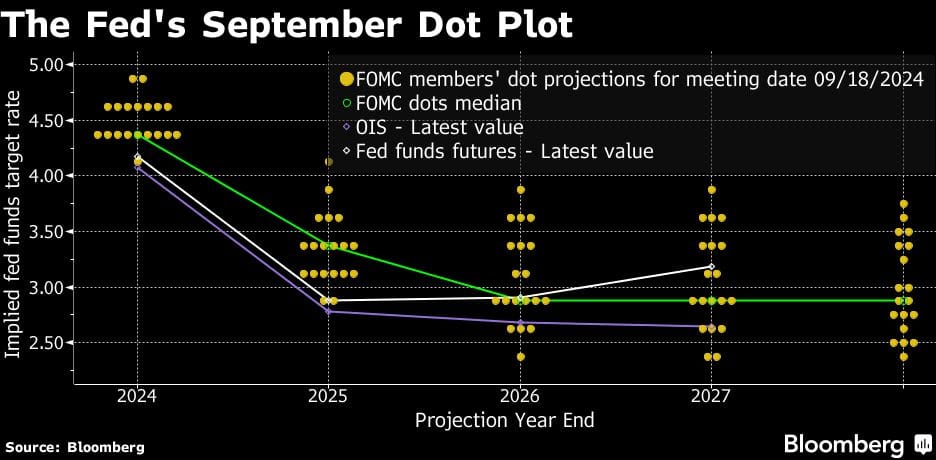

Meanwhile, The U.S. Federal Open Market Committee's (FOMC) September dot plot - an indicator of participating members' interest rate projections - showed that it expects to lower the benchmark interest rate to 4.4% this year. In the June dot plot, the Fed saw rates falling to 5.1% by the end of the year, meaning the Fed is expected to cut rates by an additional 0.5 percentage point at the remaining two FOMC meetings of the year. This year's FOMC is scheduled to take place on November 6-7 and December 17-18.