US BTC spot ETF tops $5 billion in daily trading volume the day before... Buying on Fear?, CME Fedwatch sees September ban cut as more likely...

According to Cryptoslate, the daily trading volume of U.S. Bitcoin spot ETFs surpassed $5 billion on Friday (local time). This is the first time since mid-April. The previous day, BlackRock's bitcoin spot ETF IBIT had the largest daily volume of nearly $3 billion, increasing its assets under management by $172 million. Fidelity's FBTC traded more than $858 million, making it the second-largest after BlackRock. Grayscale's GBTC saw $693 million in daily trading volume, but saw net outflows of about $148 million. Eric Balchunas, senior ETF analyst at Bloomberg, commented: "BTC bulls don't like to see high trading volumes when the market is in bad shape. This is because it is a reliable indicator of market fear. However, it's also good in the long run to see abundant liquidity on days like this. It's good for traders and institutions," he concluded.

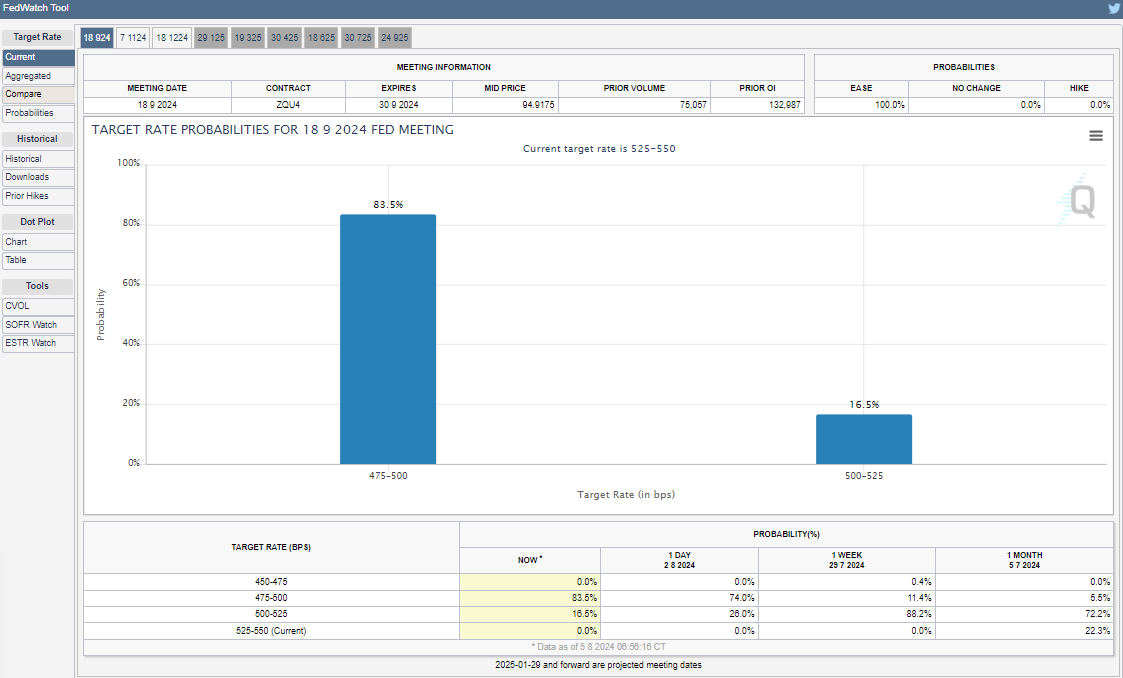

Meanwhile, According to CME Fedwatch, traders see an 83.5% chance that the U.S. Federal Reserve (Fed) will cut its benchmark interest rate by 50 basis points at the September Federal Open Market Committee (FOMC) meeting. That compares to an 11.4% chance just a week ago. Traders also put the odds of a 25-basis-point cut at 16.5%, with no traders expecting a pause.