The launch of an Ethereum spot ETF may be just around the corner. A look at the operators' policies...

"The U.S. Securities and Exchange Commission (SEC) has approved 19b-4 (trading rule change) filings for the Grayscale Ethereum Mini Trust and ProShares Ethereum ETF," Bloomberg ETF analyst James Seifat reported via X. "The SEC has approved the Grayscale Ethereum Mini Trust and ProShares Ethereum ETF. This means that both products are likely to launch at the same time as other ETFs," said Mr. Khan. He continued, "Grayscale has filed an S-1 for the Ethereum Mini Trust. The management fee is 0.25%," he added. "Grayscale's Ethereum Mini Trust fee hasn't been disclosed yet, but I think it will be lower than that," he said, noting that Grayscale had previously announced that it would maintain the 2.5% management fee for the Ethereum Trust (ETHE). It's probably around 0.15%," he said.

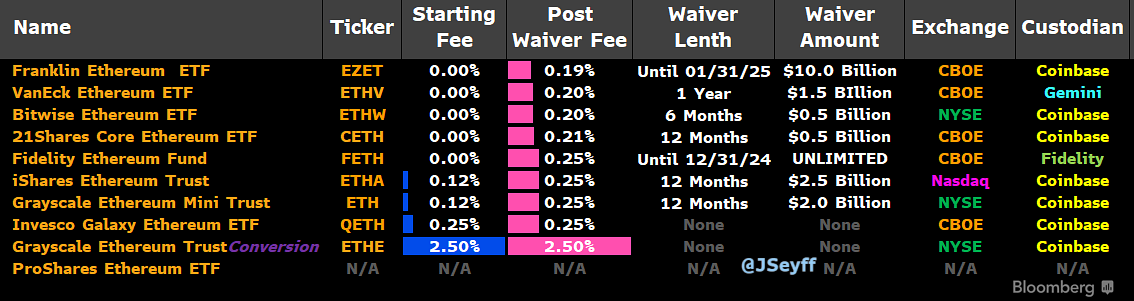

Meanwhile, Bloomberg ETF analyst James Seyffart has revealed the fees, tickers, custodians, and other information for nine of the ten Ethereum (ETH) spot ETFs that U.S. asset managers have filed for approval with the U.S. Securities and Exchange Commission (SEC), via X. Below are the ETFs' management fees (in descending order), as compiled by Coinness. Seven of them are waiving fees for a limited time.

-Franklin Templeton EZET: 0.19%.

-VanEck ETHV, Bitwise ETHW: 0.2%.

-21Shares CETH: 0.21%; and

-Fidelity FETH: 0.25

BlackRock ETHA, Invesco Galaxy QETH: 0.25% - Grayscale ETHE: 0.25

-Grayscale ETHE: 2.5