Market influencers weigh in on the Bitcoin price outlook

In a recent report, Geoffrey Kendrick, an analyst at British multinational bank Standard Chartered (SC), said, "Bitcoin will hit a new all-time high in August. It could then reach $100,000 by the U.S. presidential election in November," he said in a recent report. "If current U.S. President Joe Biden decides to run for the Democratic presidential nomination, it could increase the odds of Republican candidate Donald Trump winning, which would be favorable for Bitcoin. Conversely, if Biden drops out of the race in late July and is replaced by an influential candidate like Michelle Obama, the BTC price could weaken. This could push the BTC price to $50,000 to $50,000, which means that if Biden decides to stay in the race, there is a fantastic opportunity to buy BTC. August 4 (local time) is the deadline for candidates to file for the US presidential election. Keep an eye on Biden's actions leading up to that date."

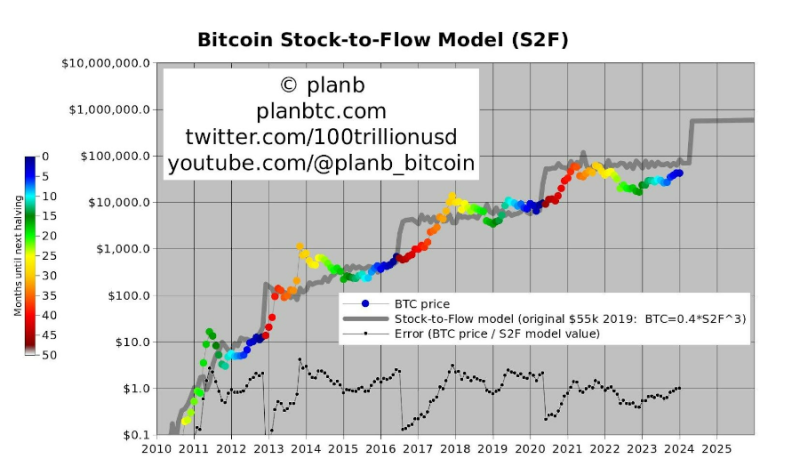

"Bitcoin is still in a bull market and will start to rebound soon," said PlanB, a well-known analyst who invented the Stock to Flow (S2F) model to predict the price of Bitcoin, on his YouTube channel. "The 5-month realized price (average on-chain acquisition price) has always been a support level in bull markets, so it's rare to see BTC price fall below the 5-month realized price, so it's interesting to see BTC below it now. The 5-month realized price is currently hovering around $65,000, and we think BTC will use this as a springboard to bounce back."

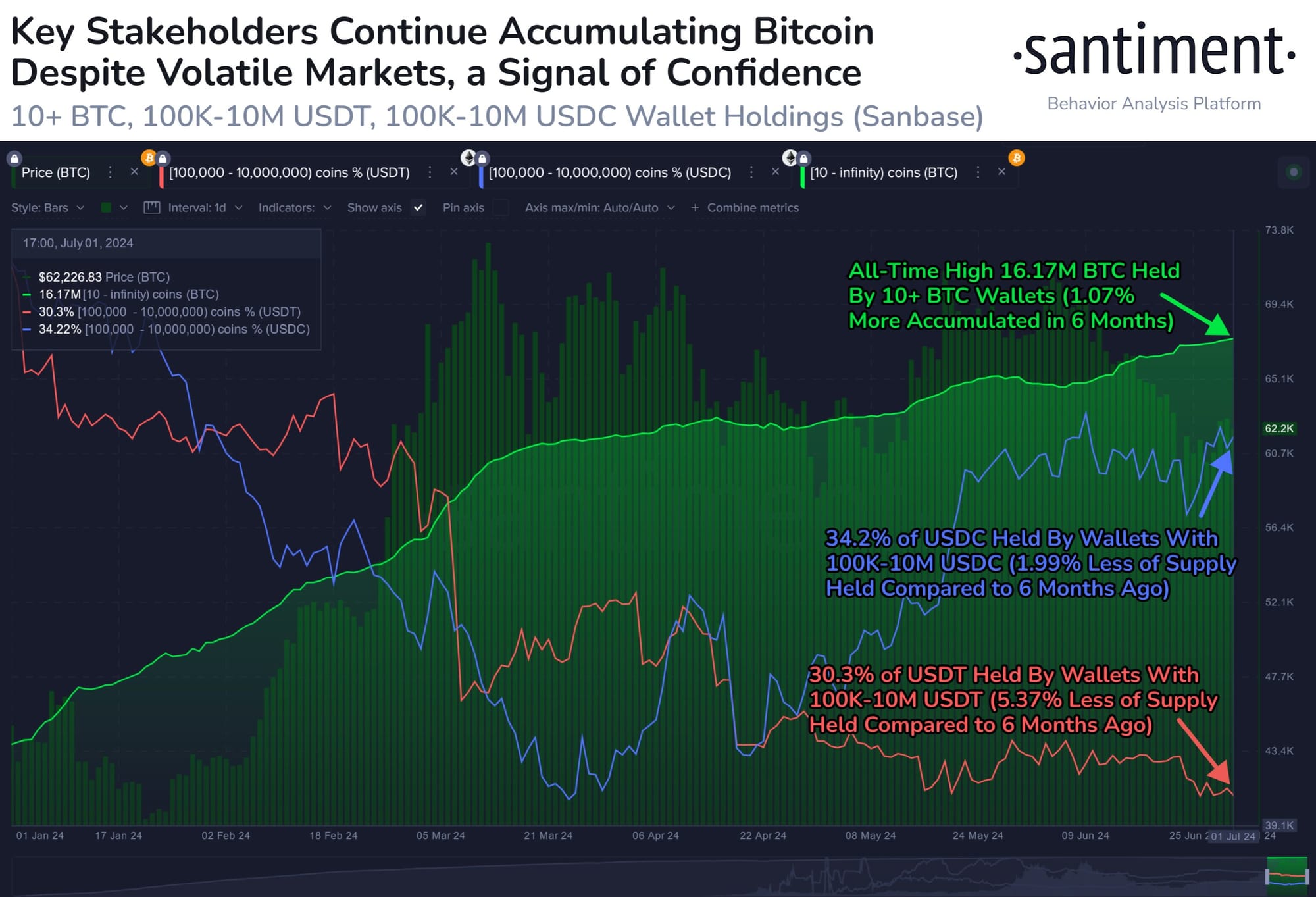

Crypto analyst Onchain Edge commented, "A wyckoff pattern is being observed on the daily chart of BTC/USD on Coinbase. The pattern suggests that BTC is currently in a consolidation phase, and a breakout to the upside could be the next step." Wyckoff patterns are used as a tool to predict trend reversals in assets and are divided into accumulation patterns (reversals to the downside) and distribution patterns (reversals to the upside). Each pattern consists of five stages, from A to E, and is divided into four market cycles. "The decline in Bitcoin holdings on major crypto exchanges suggests that BTC is being pulled off exchanges and that investors are buying back. This is consistent with the accumulation phase of the Wyckoff pattern." Another anonymous crypto trader, Rekt Capital, wrote in an X post on Jan. 1: "The upper resistance of the downtrend line on the daily chart of BTC/USD on BitMEX has been broken. On a longer timeframe, the triangular convergence of the bull flag pattern is over and the uptrend could resume."

Quoting Bitfinex's weekly analyst report, "Bitfinex Alpha," "There has been a clear decline in BTC volume transferred out of major Bitcoin miner wallets recently, suggesting a potential miner sell-off. This could be positive for the price of Bitcoin, and the uptrend could resume soon." "Since the fourth Bitcoin halving in April, miners' 'mining rewards' have been halved. Higher operating costs and the deteriorating profitability of some older mining machines have forced miners to cash out their BTC holdings. However, the recent decline in miner volumes suggests a positive trend change. With the Bitcoin network hashrate falling to levels last seen at the bottom of the 2022 bear market, it is reasonable to conclude that miner selling pressure has peaked. The inefficient miners have already surrendered," he explained.