Jerome Powell gives up on doves...is a preemptive rate cut this summer off the table?

U.S. Federal Reserve (Fed) Chairman Jerome Powell has finally turned from a "dovish" (favoring monetary easing) to a "hawkish" (favoring monetary tightening). He said on Saturday (local time) that inflation came in higher than expected for the third consecutive month earlier this year, citing a "lack of further progress toward the 2 percent target this year" and that "it is likely to take longer than previously expected to build confidence that we are on track to reach that target. Expectations that the Fed could preemptively cut rates this summer have all but disappeared, reviving fears of higher for longer.

"Inflation continues to move lower, but not quickly enough," Powell said at a Washington Policy Forum event on the Canadian economy in Washington, D.C. "Recent data have not given us greater confidence, but rather suggest that it will take longer than expected to gain that confidence," he said.

"Given the strength of the labor market and the progress of inflation so far, it is appropriate to allow restrictive policies to work more effectively," he added.

Powell has maintained dovish (monetary easing) signals despite higher-than-expected inflation data over the past month or two. "It's still too early to tell whether the latest numbers on inflation represent more than a bump on the road," he said in remarks at a forum at Stanford University on March 3. "But the recent data do not materially change the overall picture of solid growth, a strong but rebalancing labor market, and inflation on a sometimes bumpy path back to 2%."

However, the dovish coloring was wiped away when even March consumer prices beat expectations, citing a "lack of further progress." Last month, retail sales rose 0.7% month-over-month, well above market expectations (0.4%).

Powell's comments suggest a clear shift in the Fed's outlook after three straight months of higher-than-expected inflation numbers. At the Federal Open Market Committee (FOMC) meeting in March, the Fed maintained its outlook for three rate cuts this year in a dot plot, but nine of the 19 members now forecast two rate cuts. If only one of the nine members who projected three rate cuts changed their minds, the Fed's forecast would be reduced to two rate cuts this year.

In recent days, Fed officials have already signaled a lack of urgency to cut rates, sending a series of warnings to the market. Minneapolis Federal Reserve Bank President Neil Kasichari said on April 4 that a rate cut may not be necessary this year if inflation slows and the economy remains strong. Atlanta Fed President Rafael Bostic also warned on Wednesday that a rate cut would likely be limited to one in the fourth quarter of this year.

Markets, which were expecting six or seven rate cuts earlier this year, have now significantly lowered their expectations. According to the CME's FedWatch tool, the probability of the Fed cutting rates in June has fallen to 16.9% at the close of trading, and the likelihood of a July cut is only 44.4%. A September cut is about 70% likely. The only remaining Federal Open Market Committee (FOMC) meetings are in November and December. Given that November is the U.S. presidential election, which makes it difficult to change policy, at best we can only expect two cuts this year.

"Powell's comments signaled that the Fed is likely to keep rates on hold for longer than originally planned," said Jeffrey Roach of LPL Financial.

"I think (current) policy is well positioned to address the risks we face," he said, adding that "at this point, given the strength of the labor market and the progress of inflation so far, it is appropriate to allow more time for restrictive policies to take effect." Former U.S. Treasury Secretary Larry Summers, who is highly influential in financial markets, recently rattled markets when he said in a Bloomberg TV interview that "we should seriously consider the possibility that the next rate move will be a hike, not a cut," but he drew a line in the sand.

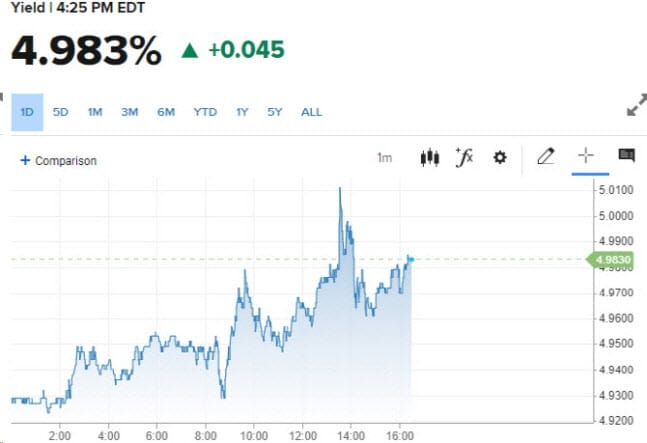

As Powell reinforced the prospect of "prolonged high interest rates," Treasury yields spiked and equity markets turned lower. On the New York bond market, the U.S. two-year Treasury yield rose to 4.696%, the highest since November of last year, and the 10-year Treasury yield rose to 5.5%. The S&P 500 and Nasdaq closed lower. The dollar also strengthened for a fifth straight day. The dollar index, which tracks the greenback against a basket of six major currencies, rose 0.16% to above 106, its highest level since November last year.