Stablecoin inflow stops after BTC halving... Crypto analysts have their eyes on $60,000

According to a 10x Research report, “the growth in stablecoin supply has stopped after the Bitcoin halving on April 20th”. Currently, the market capitalization of the top three stablecoins - USDT, USDC, and DAI - has been fluctuating between $149 billion and $150 billion over the past three weeks.

“Since the halving, capital inflows into stablecoins have been near zero, and BTC futures leverage ratios have decreased dramatically,” said 10xResearch. In the coming weeks, BTC could experience a correction to sub-$55,000 and Ethereum (ETH) could fall to $2,500.”

On the other hand, crypto newsletter LondonCryptoClub predicts that “the US Consumer Price Index (CPI) is expected to come in more positive than expected, which will push BTC above $65,000.” The US CPI for April will be released on April 14th.

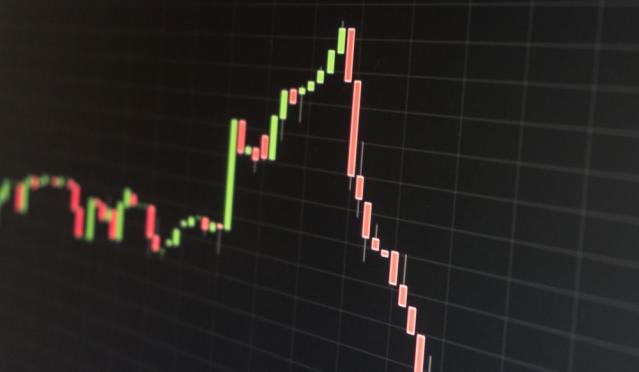

Meanwhile, Alex Kuptsikevich, senior market analyst at forex trader FxPro, said, “A panic sell-off could occur if the price of Bitcoin closes a candle below $60,000.” “The recent Bitcoin price action has been characterized by consecutive lower highs and lower lows,” he said, adding, “A close below $60,000 could trigger a panic cell, but a positive scenario could develop if the price manages to retake the $65,000 level and hold the 50-day moving average price from early May.”

Analysts at RiseLabs, another crypto investment firm, said: “The behavior of BTC short-term holders (holding less than 155 days) could have a major impact on the market in the coming months. In a bull market, it is common for long-term holders to sell to short-term holders. However, after the peak, this pattern is reversed as short-term holders' losses increase sharply, and the volume is transferred back to long-term holders. In the four to six months after this phenomenon is observed, the Bitcoin price invariably suffers a significant drop.”