Ethereum ETF launches favorable price Shelly Young comments and Grayscale's Ethereum liquidity outflow

Hany Rashwan, CEO of crypto ETP issuer 21Shares, told Bloomberg that the launch of an Ethereum spot ETF has already been partially priced in. "Global macroeconomic and summer seasonal features have also impacted the price of ETH," he said. "While Bitcoin is a digital gold hedge, Ethereum is known for its practical applications in areas such as DeFi. The Ethereum blockchain is the foundation for smart contracts, stablecoins, and other financial applications."

21Shares' Ethereum (ETH) spot ETF (ticker: CETH), which launched on U.S. exchanges, saw $7.4 million worth of inflows on its first day of trading. Meanwhile, according to financial information platform Farside Investor, out of the nine ETH spot ETFs that launched simultaneously on March 23 (local time), Bitwise's ETHW has seen the largest inflows to date, with $204 million, followed by Franklin Templeton's EZET with $13.2 million. Outflows and inflows for BlackRock's ETHA, Fidelity's FETH, and Grayscale's ETHE are not yet available. Previously, Coinness reported that ETH spot ETFs surpassed $1 billion in trading volume on their first day of trading, with Grayscale's ETHE accounting for about half of that.

Meanwhile, Grayscale, which accounts for half of the volume, saw outflows of about $4.84 billion on the first day of trading for its Ethereum (ETH) spot ETF, while Grayscale's other "mini" ETF, ETH, saw inflows of $15.2 million. So far in the first day of ETF trading, ETHW has reportedly seen the largest inflows of $203 million, followed by EZET with $13.2 million and CETH with $7.4 million. Including the inflows and outflows of Grayscale ETHE, there have been an estimated $244 million in net outflows from ETH spot ETFs to date. Meanwhile, outflow and inflow figures for BlackRock's ETHA, Fidelity's FETH, VanEck's ETHV, and Invesco's QETH have not yet been released.

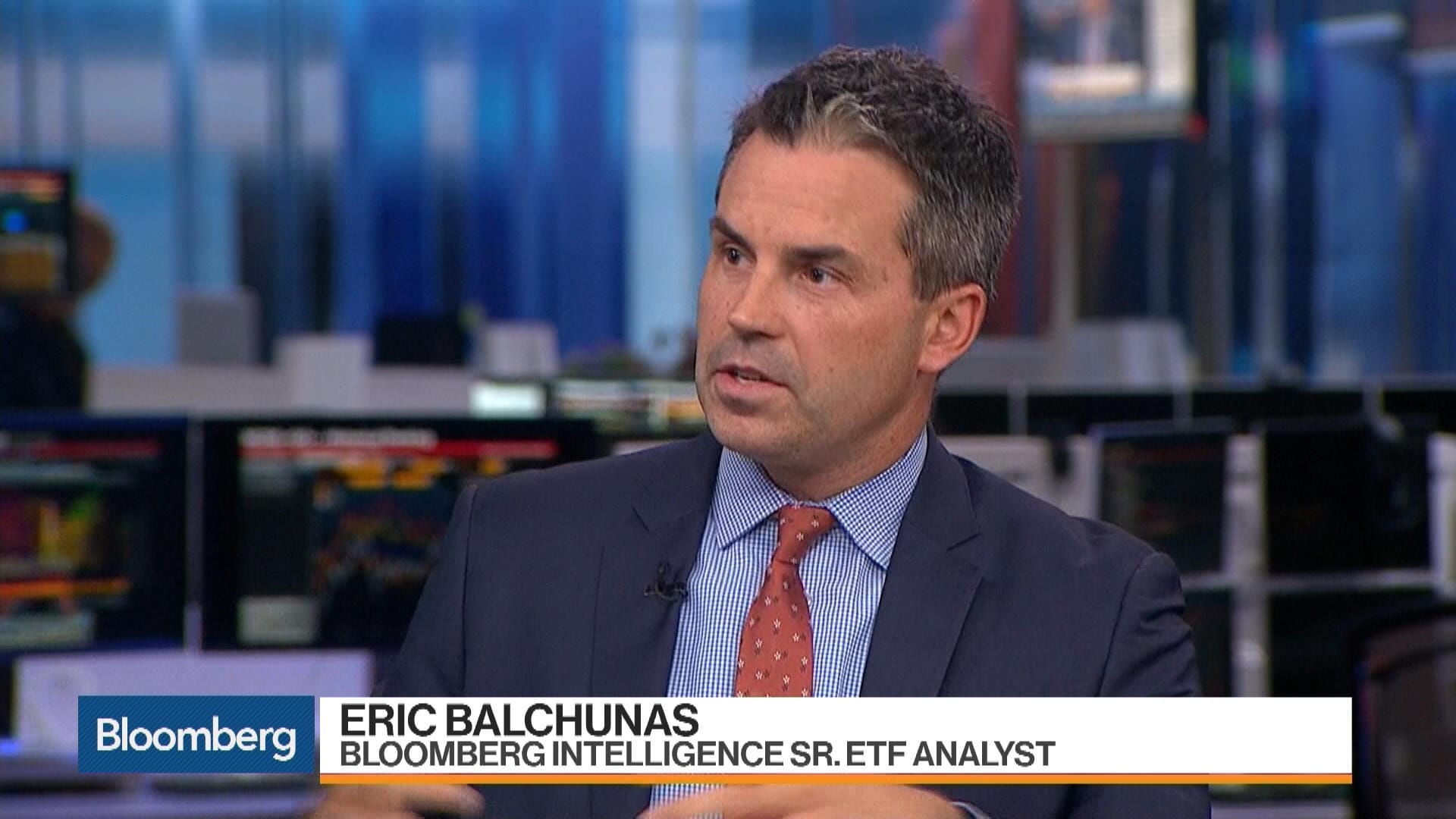

About this, Bloomberg ETF analyst Eric Balchunas tweeted on his X (formerly Twitter), "The Grayscale Ethereum (ETH) Spot ETF saw $484 million in outflows on its first day of trading. This is equivalent to 5% of the fund's assets under management. I don't know if the remaining 8 ETFs can offset these outflows." "On the flip side, the outflows from Grayscale's ETH spot ETF may be best ended as quickly as ripping off a band-aid," he added. On the first day of trading, ETH spot ETFs reported net outflows of approximately $244 million, with BlackRock, Fidelity, VanEck, and Invesco not reporting inflows and outflows for their ETH spot ETFs.