ETH spot ETF approval odds raised to 75% this month, sending Ethereum price soaring

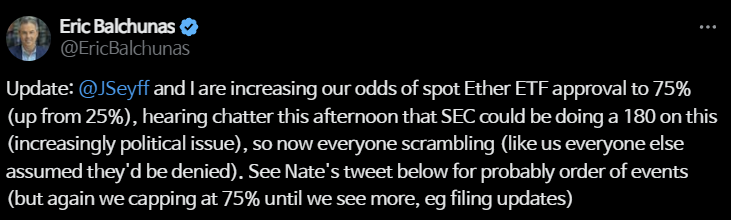

Bloomberg ETF analyst Eric Balchunas reports via X that “I'm raising my forecast for the probability of the U.S. Securities and Exchange Commission (SEC) approving an Ethereum (ETH) spot ETF to 75% this month. Today, we heard that the SEC could do a 180-degree turn on the issue.” In March, Eric Balchunas had estimated a 25% chance of approval of an ETH spot ETF in May. His colleague James Seifat added: “We're hearing from multiple sources that the SEC may be reversing its position. If we're right, we're going to see a lot of filings over the next few days.” When reviewing a new ETF, the SEC must approve both a 19b-4 (a formal request for review) and an S-1 (a securities registration statement), and the May 23rd deadline for the VanEck Ethereum ETF and the 24th for the Ark21Shares Ethereum ETF.

In the meantime, traders are aggressively building long positions in the futures market on news that an Ethereum (ETH) spot ETF could be approved this week. ETH prices are up 11% in one hour, and open interest has increased by nearly $1 billion.