Open interest plummets after January BTC options expiration, whales holding over 1,000 BTC buy $3 billion BTC this month, weighing on further gains?

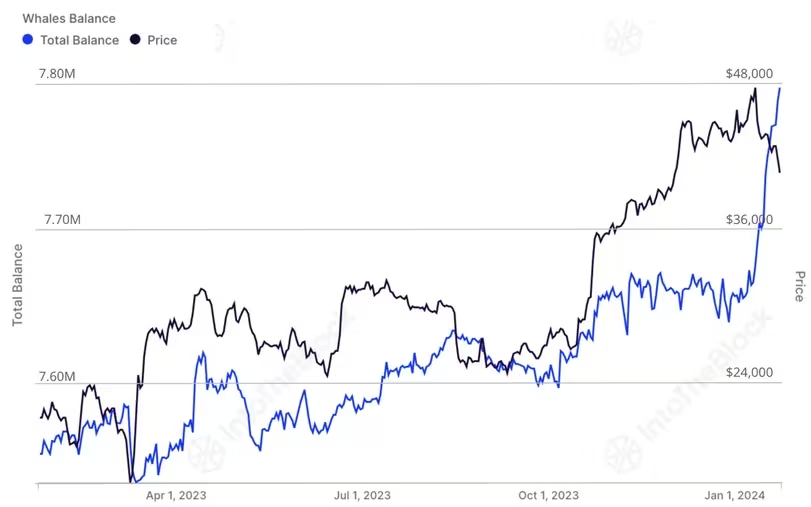

Hong Kong crypto media outlet Meta Era, citing Into the Block data, reports that "whale addresses holding 1,000 BTC or more bought a total of 76,000 BTC (worth $3 billion) in January. They hold an average of $7.8 million worth of BTC," weighing in on the possibility of further gains.

Meanwhile, crypto derivatives trader Gorden Grant told The Block: "Options open interest dropped significantly last week after the January Bitcoin Friday options expired. A drop in open interest at current levels could boost BTC's upside." Total open interest in BTC options expiring last Friday was at a record high of more than $13 billion, according to TheBlock data, but dropped by more than $3 billion to $98.8 billion after expiration. "Analysts and bears were predicting that BTC would correct and fall to $33,600, but that didn't happen," added Gordon Grant.