Las opciones IBIT de BlackRock alcanzan los 1.900 millones de dólares en su primer día de cotización, Grayscale comienza a cotizar el 20 de noviembre.

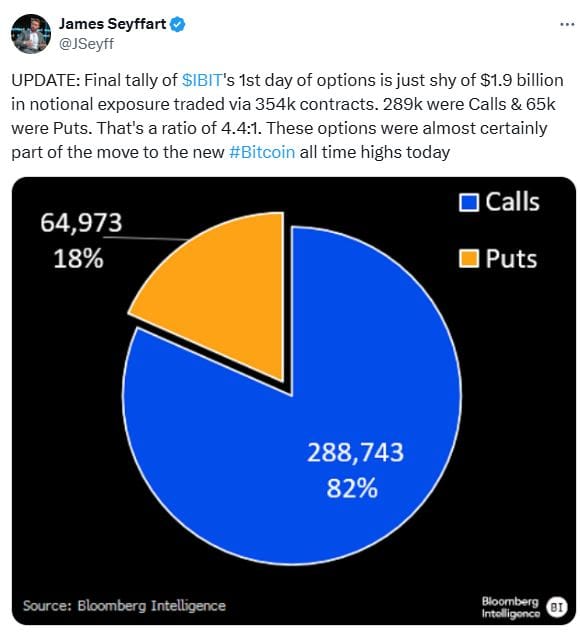

Bloomberg ETFs analyst James Seyffart reports via X that “Options volume on BlackRock's bitcoin spot ETF IBIT, which began trading today (Nov. 19), was about $1.9 billion. A total of 35.4 million contracts were active, of which 28.9 million were calls (82%) and 65,000 were puts (18%). The ratio is 4.4:1. These options trades may have contributed to the new all-time high for Bitcoin.”

Meanwhile, Grayscale has announced that options trading on GBTC and BTC will begin today (Feb. 20) via Official X. The company says this will allow for the first time ever for a U.S.-listed cryptocurrency. “We expect this to further develop the ecosystem centered around Bitcoin ETPs listed on the US markets,” the company said. Earlier, crypto asset manager Bitwise CEO Hunter Horsley also said that options trading on its product BITB was expected to begin on the 20th.