Cryptocurrency Market Wipes Out $300 Billion...Jumping Crypto Asset Sales Spur Downward.

The cryptocurrency market has suffered its biggest drop in over a year with a steep decline in the last three days, according to BlockMedia. Poor employment data and recessionary fears have driven the stock market lower, which has also affected the crypto market. According to Cointelegraph, the crypto market lost $313 billion in market capitalization in the three days since Aug. 2. This is the largest decline since mid-August 2023.

Solana (SOL), one of the top 10 cryptocurrencies, has plummeted 25.7% since July 30, falling from $184 to $137. Bitcoin (BTC) and Ethereum (ETH) are also down 14% and 17%, respectively. The plunge was largely driven by weak employment data, slowing growth in major tech stocks, and fears of a recession. Major companies such as Microsoft and Intel reported lower-than-expected Q2 earnings, which negatively impacted the market as a whole. Nvidia, a major player in the market, was also hit as capital moved to smaller companies in anticipation of interest rate cuts.

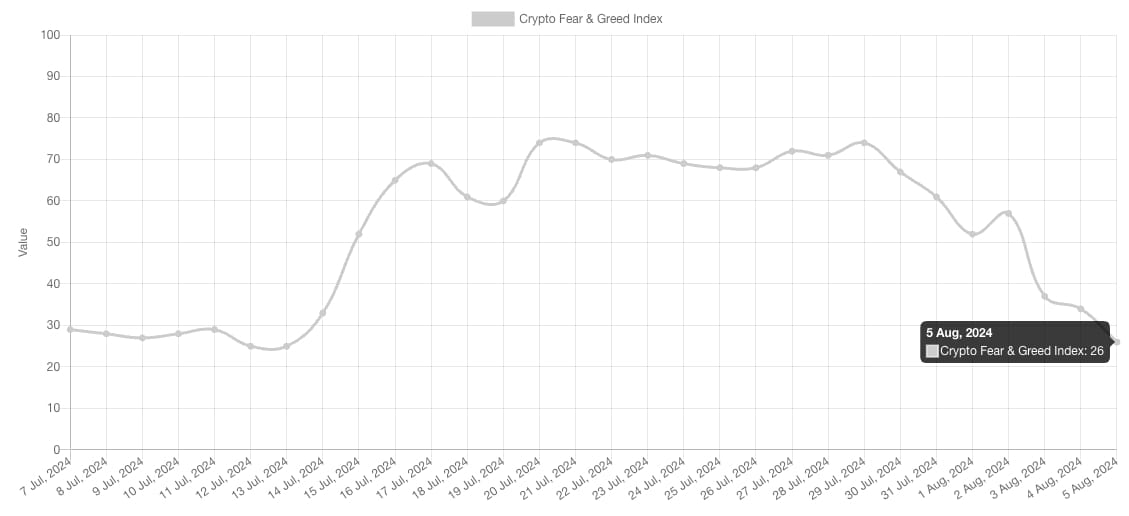

Market experts believe that Jump Crypto's massive asset sale exacerbated the plunge. According to Arkham Intelligence data, Jump Crypto has sold hundreds of millions of dollars worth of assets in recent days. According to Alternative, the Crypto Fear and Greed Index, which tracks investor sentiment towards Bitcoin and the crypto market, has now fallen to the "panic" level, and was at 26 at the time of writing.

Cryptocurrencies are likely to face a tough week ahead. "Bitcoin has entered a CME gap, but technically it can only be filled during traditional financial trading hours," said Keith Alan, co-founder of Mutual Indicators, adding that the future recovery of the crypto market "will depend on increased spot demand fr