Crypto spot ETFs all over the place, BTC ETF volumes up but 2 days of net outflows, ETH ETF approval expected by month's end

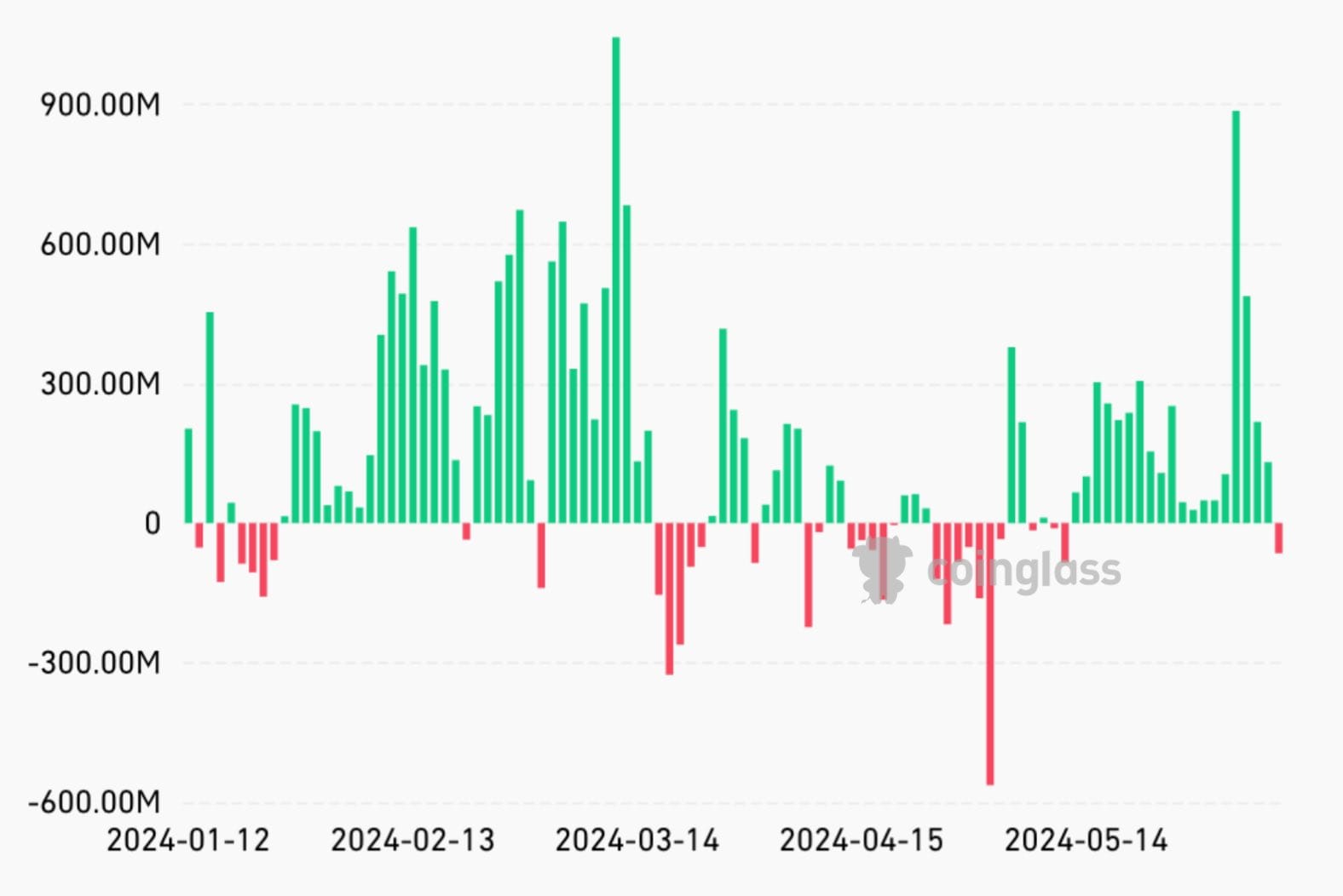

According to crypto analysts HODL15Capital (@HODL15Capital), US Bitcoin spot ETFs saw net outflows of $200 million on June 11 (local time). This was the second consecutive day of net outflows, with $121 million in outflows from Grayscale GBTC, $56.5 million from ARKB, $12 million from Bitwise BITB, and $7 million from Fidelity FBTC. BlackRock IBIT saw no net inflows or outflows.

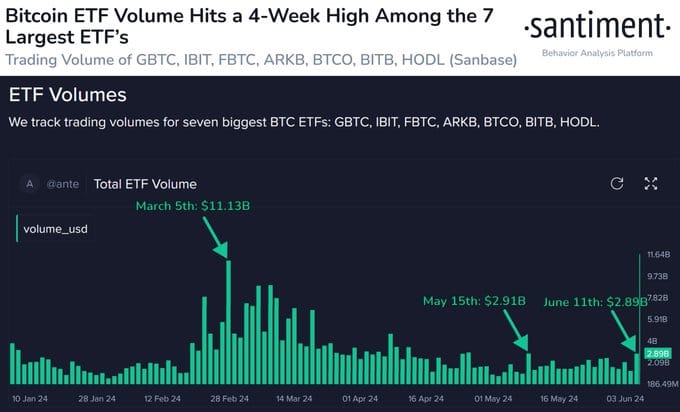

According to crypto on-chain analytics platform Santiment, “trading volumes in the top seven Bitcoin spot ETFs surged on Nov. 11 to the highest level since the 15th of last month. The surge in trading volumes could increase the likelihood of a price rebound.” According to the data, the trading volume of the top seven BTC spot ETFs (GBTC, IBIT, FBTC, ARKB, BTCO, BITB, and HODL) was $2.91 billion on May 15 and $2.89 billion on May 11.

Meanwhile, Nate Geraci, CEO of US ETF specialist ETF Store, said: “While nothing is set in stone, I would be surprised if an Ethereum (ETH) spot ETF S-1 is not approved by the end of this month. A Bitcoin spot ETF and an ETH futures ETF have already been approved. The SEC has no reason to delay approving an ETH spot ETF." The SEC previously required applicants for an ETH spot ETF to file an S-1 amendment, which VanEck, BlackRock, Franklin Templeton, and others have done. “It is expected to take two to three months for the SEC to approve the S-1 for an ETH spot ETF,” Nate Geraci said late last month.