Crypto influencers' predictions for the upcoming Bitcoin halving

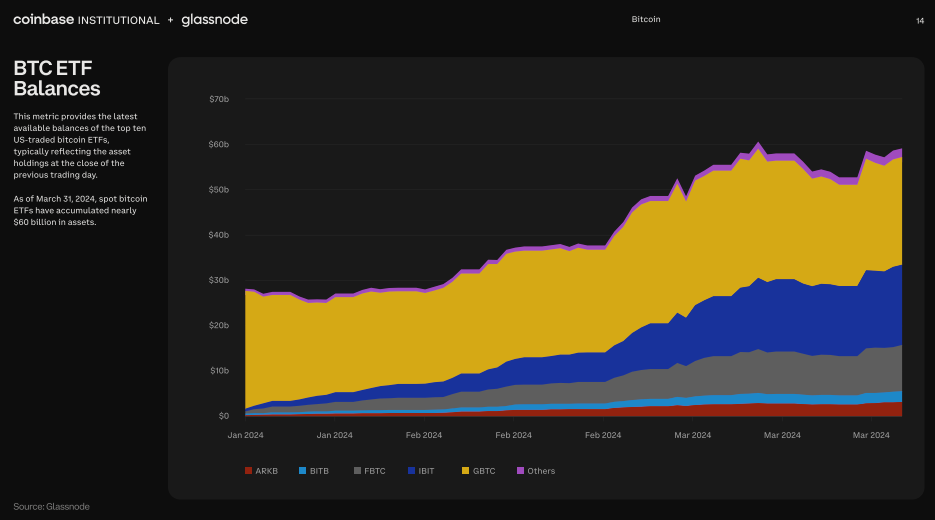

Coinbase doesn't seem to have high hopes for the halving. "The Bitcoin market has matured significantly since the last halving, and the direct impact of the halving on the market price is likely to be lessened by the reduction in supply," it said in a report on April 17 (local time). "While miners mine about 900 BTC per day, BTC spot ETFs tend to buy more than that. ETFs can cause large inflows and outflows of funds, which can affect market volatility. Given these factors, BTC spot ETFs are key players in the market, and their activity can dampen the effects of halving. The approval of BTC spot ETFs has attracted $12 billion in new capital, with ETFs currently holding $6 billion worth of BTC."

Rikke Staer, CEO of crypto payments company Coinify, also expressed his lack of expectations, saying, "This year's Bitcoin halving will be a 'buy on rumor, sell on news' event." "The BTC price reaction to the halving could take months, and it's unlikely to replicate the dramatic gains of past patterns," he added.

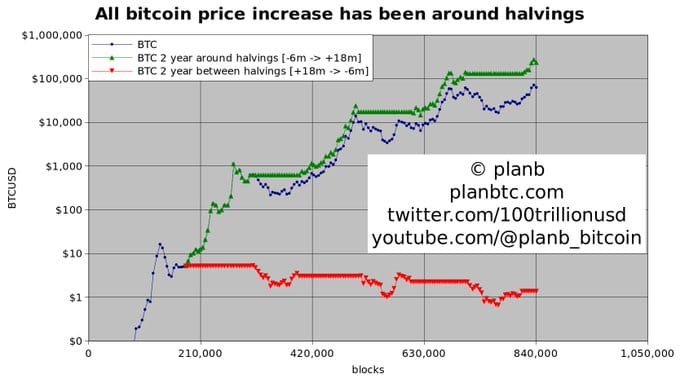

On the other hand, PlanB, a prominent influencer in the crypto community and renowned analyst who devised the Stock to Flow (S2F) model for Bitcoin price prediction, told X: "This BTC halving will be no different. All the price gains will come before and after the halving," he said. "BTC will surpass $100,000 this year, and the peak price in 2025 will be close to $300,000," he added.

Meanwhile, Bitcoin has barely held its lows since March 5, dipping below $60K at one point.