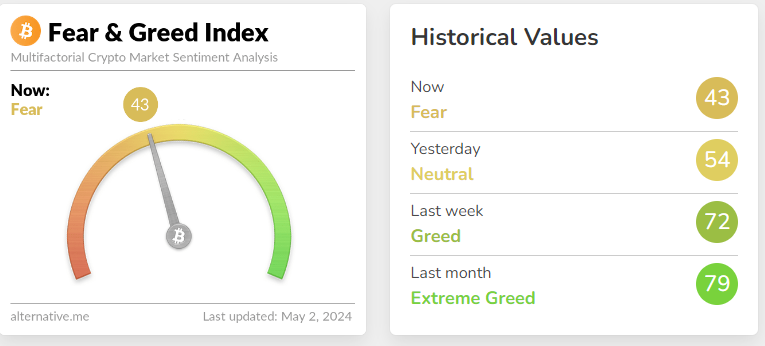

Crypto 'Fear-Greed Index' at 43... Fear shifts, a possible September rate cut, and MVRV charts suggest a buying opportunity

Crypto data provider Alternative's self-estimated “Fear-Greed Index” fell 11 points from the previous day to 43. The index moved from neutral to fear as sentiment worsened. The index indicates extreme fear in the market, with readings closer to zero indicating extreme fear, and readings closer to 100 indicating extreme optimism. The Fear Greed Index is calculated based on volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin market capitalization (10%), and Google searches (10%).

As analysts at K33 Research noted, “Investors are listening closely to the Fed's guidance on interest rate cuts. The macroeconomic outlook will be a key factor in Bitcoin price movements.” Pedro Lapenta, head of research at Hashdex, a crypto asset manager specializing in cryptocurrencies, added: “It is difficult to determine if bitcoin's halving has been priced in, and new upside drivers are needed as inflows into bitcoin spot ETFs have stopped. A less uncertain macroeconomic environment will be the main driver for Bitcoin's next rally.”

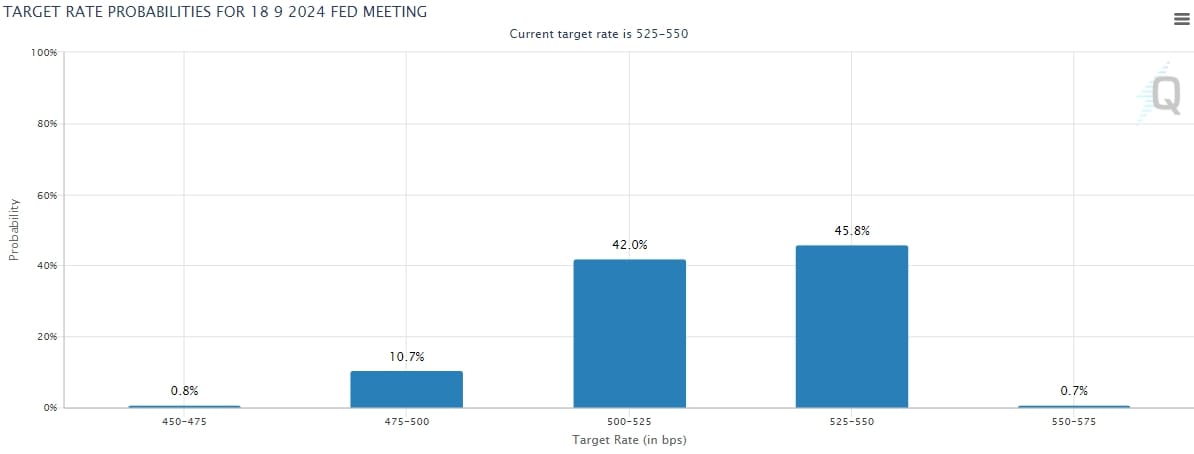

The previous day, Jerome Powell, the chairman of the US FED, kept interest rates on hold and expressed a strong commitment to future rate cuts. According to CME Fedwatch, traders put the odds of the US Federal Reserve (Fed) cutting its benchmark interest rate by 25 basis points at the September FOMC meeting at 42.0%. A 50-basis-point cut was seen at 10.7%, while a 75-basis-point cut was seen at 0.8%.

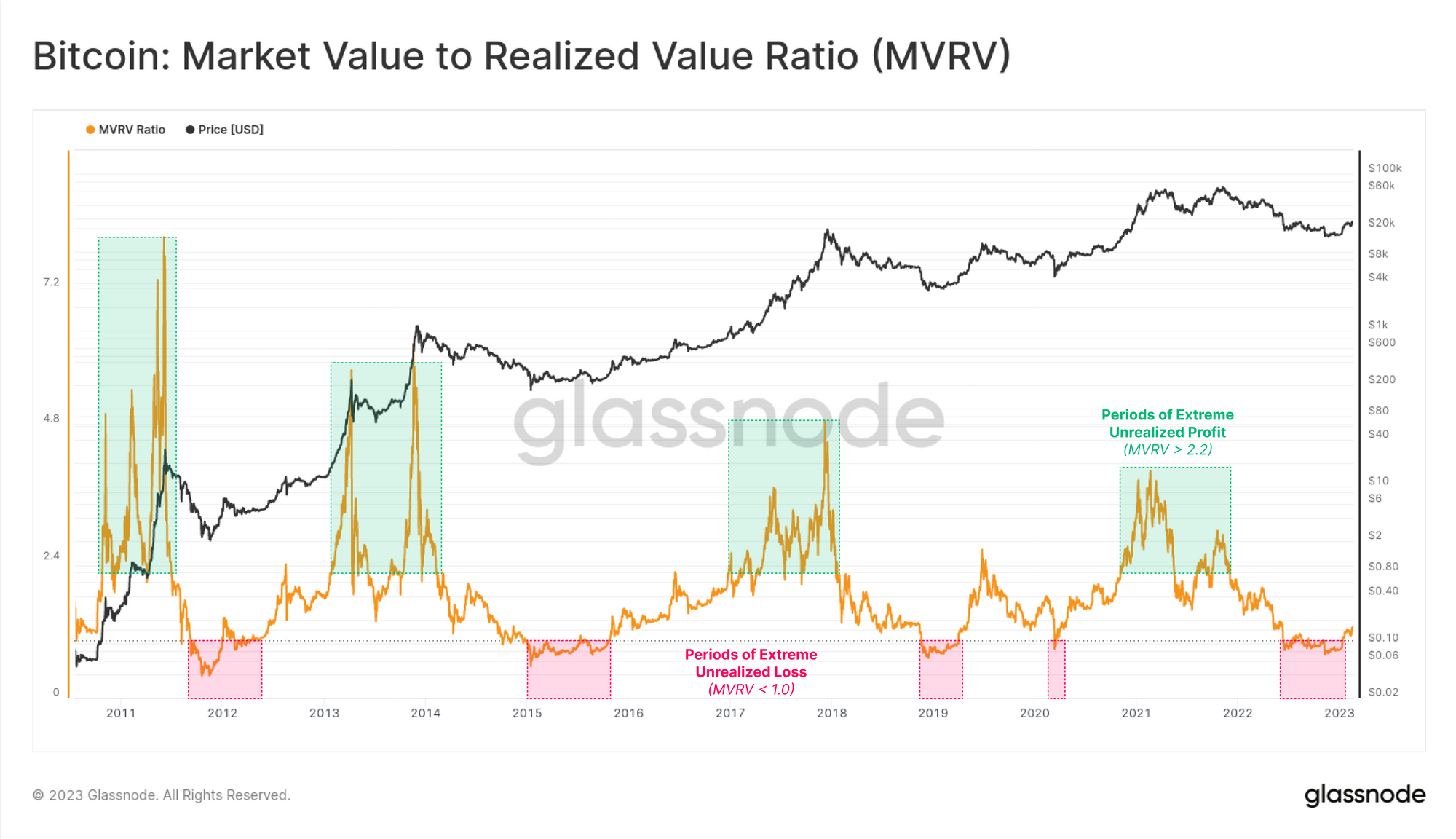

Meanwhile, crypto analyst and trader Ali Martinez told X: “In the past two years, there have been three occasions when Bitcoin's 30-day MVRV (market value to realized value) was below -9%, and BTC price surged 64%, 63%, and 99%, respectively. Currently, the 30-day MVRV is -11.6%, creating a bargain buying opportunity.”