Check out today's major crypto indices you need to know

Today could be a big day for the crypto market. First up is the expiration of a whopping $9.58 billion worth of options. The Crypto Greed Index is still hovering around the low 80s and remains extremely greedy, so that's something to keep an eye on as well. U.S. stocks closed mixed amid mixed assessments of the previous day's GDP report, while Bitcoin hovered near the $71k mark at one point.

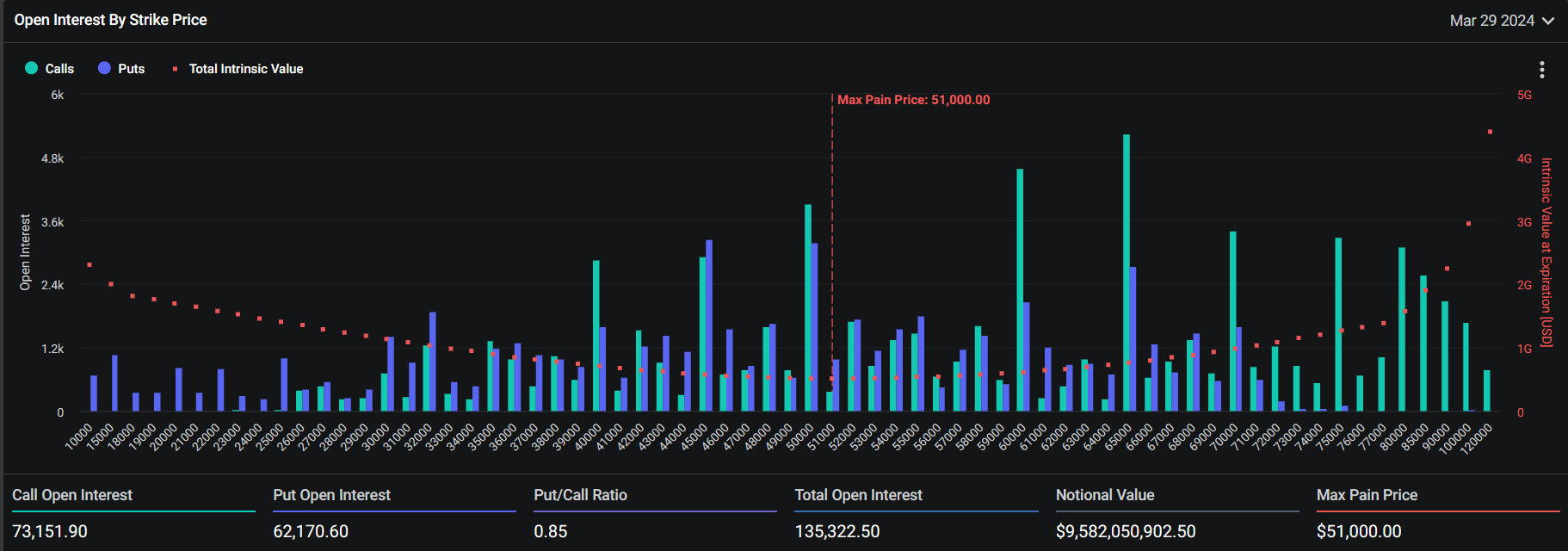

According to crypto options exchange Deribit, $9.58 billion worth of Bitcoin options expire on March 29th. The put/call ratio is 0.85 and the max pain (the price at which the most option buyers lose premium) is $51,000. At the same time, $5.62 billion worth of Ethereum options expire. The put/call ratio is 0.63 and the max pain price is $2600.

Crypto data provider Alternative's self-estimated "Fear-Greed Index" fell one point from the previous day to 79. The extreme greed phase persisted. The index indicates extreme fear in the market when it is close to zero, and extreme optimism when it is close to 100. The Fear and Greed Index is calculated based on volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin market capitalization (10%), and Google searches (10%).

Meanwhile, the U.S. Commerce Department reported that the country's gross domestic product (GDP) grew 3.4% quarter-over-quarter in the fourth quarter of last year. This was above market expectations (up 3.2%). In the third quarter, U.S. GDP growth was 4.9%. U.S. GDP growth is released in three installments: preliminary, advance, and final. Today's release is the final reading. S&P500: +0.11%, Nasdaq: -0.12%, and Dow: +0.12%, the three major U.S. stock market indices closed mixed, while our own market monitoring shows BTC above $71,000 on a number of crypto exchanges. Currently, BTC is trading at $70,700 on Binance's USDT market.