Amid predictions that BTC will hit a new all-time high this March on the back of ETFs, opinions are divided on its correlation with equities and mining

In a report released on Friday, Singapore-based cryptocurrency trading firm QCP Capital said, "The massive inflows are likely to continue as global liquidity flows into BTC spot ETFs. BTC could easily hit a new all-time high before March," the report said. "BTC has regained $50,000 for the first time in over two years. This is due to the daily inflows of around $500-650 million into BTC spot ETFs. A simple calculation shows that the US BTC spot ETF is holding 10,000-13,000 BTC daily".

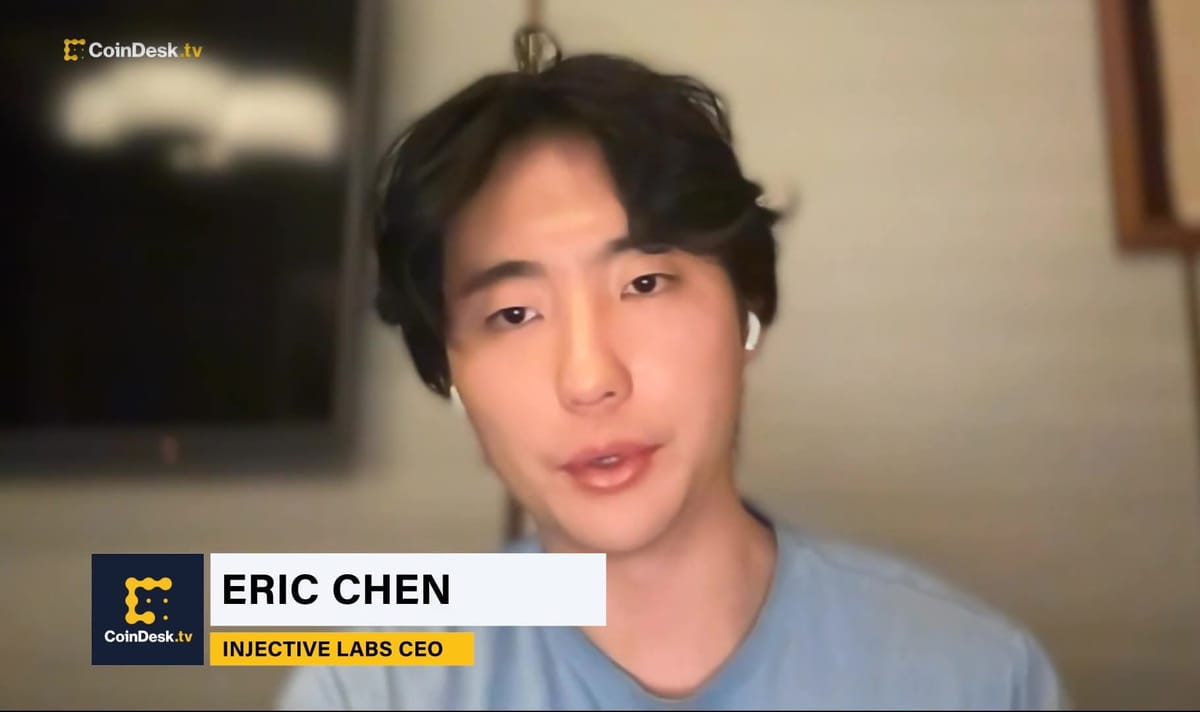

Meanwhile, Eric Chen, co-founder and CEO of Injective Labs, the developer of the Injective decentralized derivatives trading protocol, said, "As BTC spot ETFs attract more traditional financial institutions to the cryptocurrency market, the correlation between stocks and BTC is likely to return." "With the approval of the BTC spot ETF, more financial institutions are likely to trade crypto as a risky asset. Once crypto as a whole reaches a certain level of value, it may naturally be included in the portfolios of some large funds. "BTC spot ETFs are absorbing 10 times more BTC than is being mined daily," Cameron Winklevoss, co-founder of Gemini, told X. "This phenomenon will continue until the halving of BTC is complete. "If this continues until the halving, BTC spot ETFs will suck up 20 times more than is mined daily," he added.