BTC could reach at least $130,000 by the end of next year, and miners are busy selling

As Peter Brandt, a well-known US trader, said, “BTC's current behavior is similar to that of past halving cycles. If this trend continues, BTC could reach at least $130,000 by the end of 2025,” he said. “The bullish cycle started 16 months before the May 11, 2020 halving and ended 18 months after the halving. It was the same pattern during the first halving and the second halving. Based on this, the peak of this bull market cycle is expected to occur in August-September 2025.”

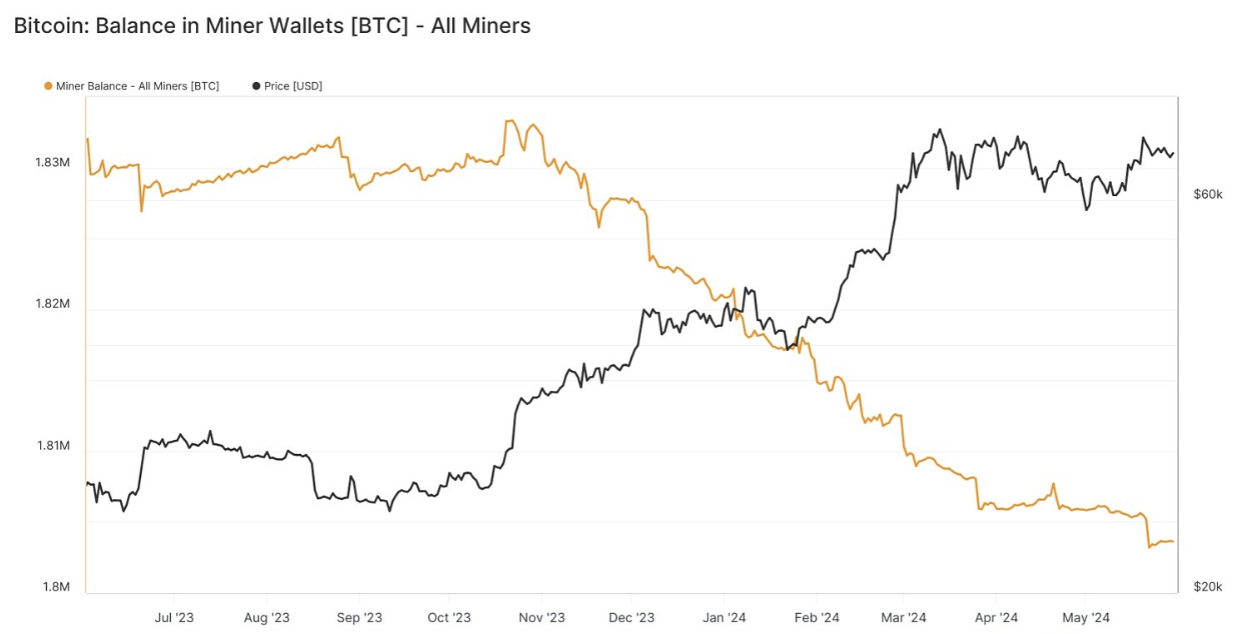

Meanwhile, Bitcoin miner holdings fell from 1.84 million BTC at the start of last year to 1.8 million BTC in May, according to Glassnode data. “The decline in miner holdings indicates increased selling to cover operating costs, which could increase further as post-halving block rewards decrease. Post-halving transaction fees accounted for 75% of miner revenue, and miners have adapted to the halving by focusing more on transaction fees. This shows a fundamental shift in miner revenue streams. It may also have implications for future mining strategies.”