Glassnode researcher sees potential for a Bitcoin pullback

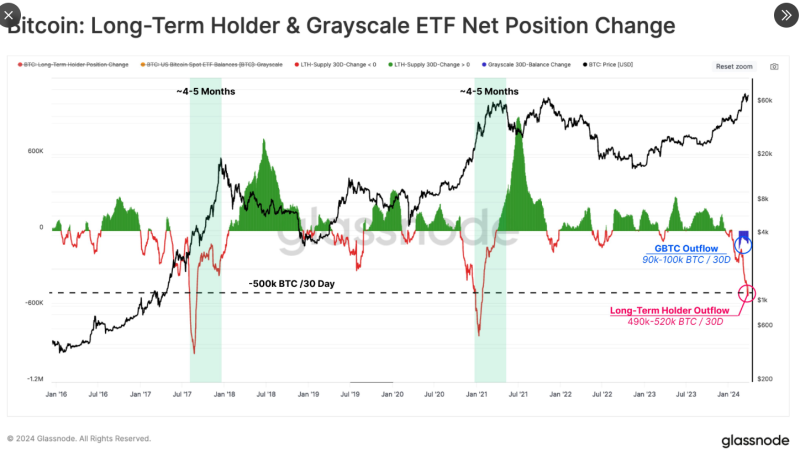

A senior researcher at on-chain analytics platform Glassnode has warned that Bitcoin (BTC) could be on the verge of a downtrend, pointing to a sell-off by long-term holders. CryptoVizArt, a senior researcher at Glassnode, tweeted on his X account on Jan. 1 that long-term holders are selling Bitcoin despite the bullish market outlook, which could lead to a decline. He characterized wallets that have held Bitcoin for more than 155 days as "long-term holders" or "diamond hands. He noted that these wallets began selling Bitcoin in December of last year, when the bull market began in earnest, and that their selling peaked in March, when Bitcoin recently hit a record high.

"In March, when Bitcoin's price hit an all-time high, Diamond Hands sold more than half a million bitcoins," he wrote. He pointed out that the timing of a typical bull market overlaps with a period when long-term holders sell Bitcoin, a pattern that typically lasts about four to five months. However, he noted that this Bitcoin bull market may not follow the pattern of past bull markets. He pointed to the sell-off in Grayscale's bitcoin spot exchange-traded fund (ETF) GBTC. "It would be different if the sell-off from long-term holders was driven by a sell-off in GBTC," he explained. GBTC has been experiencing extreme selloffs since its launch due to fees that are roughly six times higher than other Bitcoin spot ETFs in the US.