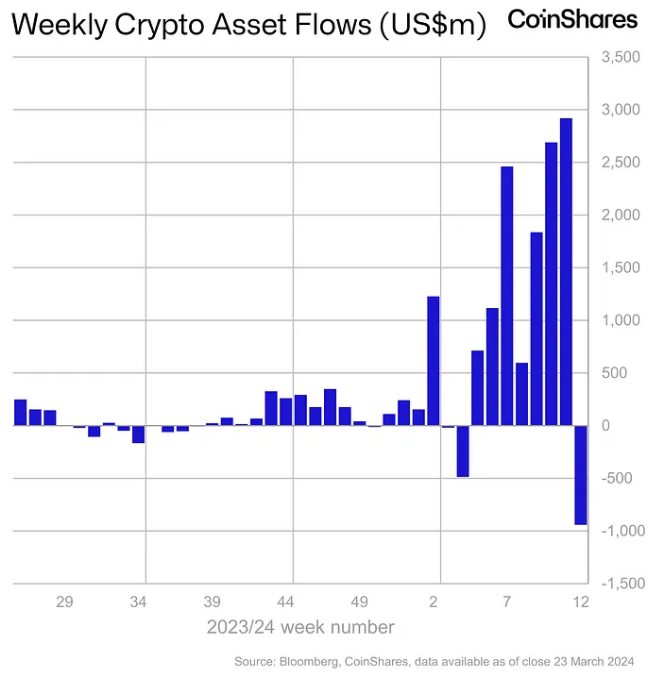

Digital investment products closed net inflows, The crypto market is more sensitive to BTC spot ETF flows than fundamentals.

Last week saw the first weekly net outflows from BTC spot ETFs, pushing the BTC price lower. This suggests that the market is more focused on ETF flows than fundamentals. Specifically, Grayscale GBTC saw outflows totaling $1.83 billion over four days, which some have linked to selling pressure on GBTC from Genesis. However, Genesis and Gemini have agreed to distribute cryptocurrency in kind to Gemini victims. Therefore, it is unclear if there is a correlation between the GBTC outflows and the selling pressure.

According to the Coinshares weekly fund flows report, digital asset investment products saw net outflows of approximately $9.42 billion last week. This ended a seven-week streak of net inflows, which had accumulated to $12.3 billion by the previous week. Approximately $2 billion in net outflows from the U.S. spot bitcoin ETF Grayscale GBTC were offset by inflows of approximately $1.1 billion into non-GBTC U.S. spot bitcoin ETFs. Bitcoin investment products saw total outflows of $9.04 billion, accounting for 96% of all net outflows in digital asset investment products. Major altcoin products such as Ethereum (ETH), Solana (SOL) and Cardano (ADA) also saw outflows of $34 million, $5.6 million and $3.7 million, respectively. Other altcoin investment products saw net inflows of around $16 million, with Polkadot (DOT) attracting $5 million, Avalanche (AVAX) $2.9 million and Litecoin (LTC) $2 million.