Bitcoin supports $60K, break of $62K will change the trend and close nearly $700M worth of shorts

Wall Street takes a breather ahead of Fed Chair Jerome Powell's speech at the Jackson Hole meeting. Bitcoin held the $60,000 level in the New York market on Dec. 22 (local time). Cointelegraph reported that the $60,000 support level held firm, supported by inflows into ETFs. Bitcoin gained 4% from Aug. 21 to 22 and has since lost some of its upward momentum, but has held the $60,000 support level. Analysts argue that only a break above the $62,000 resistance level will confirm the bull market. Given the market's confidence that the Fed will cut interest rates, Bitcoin bulls have the upper hand.

Decode, a Bitcoin analyst and investor, said that BTC price needs to rise above the 200-day moving average to “resume its bullish trend.” Bitcoin “seems to have lost momentum at the moment,” Decode said, adding that August and September will likely be a boring stretch, but he expects a strong fourth quarter. While bullish over the medium term, he sees no immediate catalysts to close the gap between Bitcoin and traditional markets.

The Fed is expected to cut interest rates at its Sept. 18 meeting. Some economists have raised the possibility of a 0.50% rate cut. This would be an aggressive move and could be favorable for risky asset markets. Such a rate cut would lower the reward for fixed-income investments such as U.S. Treasuries and reduce the cost of capital for companies. Even a 0.25% rate cut would signal the end of the most severe phase of monetary tightening. The price of gold took advantage of this and hit a record high on August 20th. Bitcoin, on the other hand, remains 16% below its all-time high of $71,943 in June 2024.

In addition to macroeconomic trends, the crypto industry is seeing a more favorable outlook ahead of the U.S. presidential election in November. Candidates have a strong incentive to publicly support the digital finance industry. According to an August 21 Bloomberg report, Democratic presidential candidate Kamala Harris has pledged to support the continued growth of the crypto industry. After all, as long as the U.S. employment and inflation data remains positive, the Fed will be more likely to ease monetary policy. This could reduce the government's debt-servicing costs, but it could also weaken the domestic currency as investors seek better fixed-income opportunities.

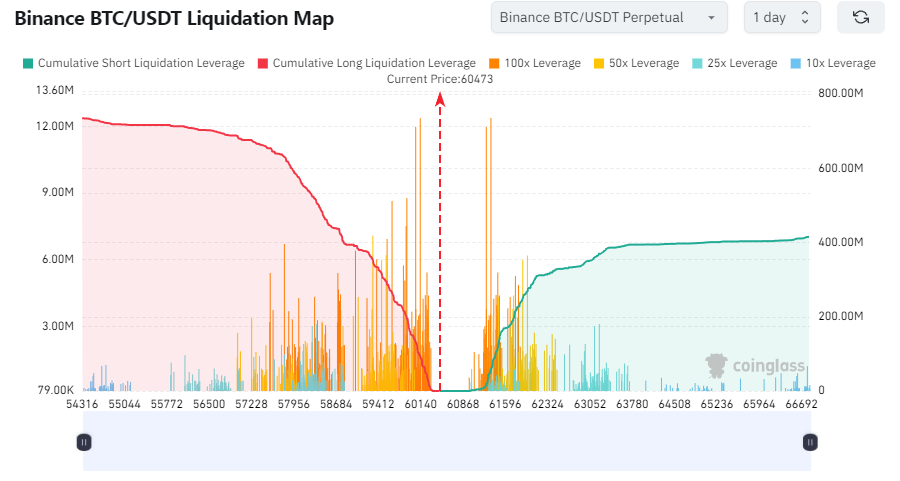

Cointelegraph reported that a break above $62,000 would still be a bullish sign for bitcoin. If bitcoin exceeds $62,000, the cumulative short order liquidation strength on major centralized exchanges (CEXs) will reach $780 million, according to Coinglass data. If Bitcoin falls below $59,000, the cumulative long order liquidation strength on major CEXes will reach $1.225 billion.