Long-term investors switch to BTC holdings, holding on despite 95%+ market decline

James Check, lead on-chain analyst at Glassnode, wrote on his X that “Bitcoin selling pressure has decreased dramatically compared to two months ago. This is due to more long-term investors wanting to hold BTC,” he said. “The Value Days Destroyed (VDD) multiples have cooled down over the past few weeks, and the major cryptocurrencies are back in buyback mode,” he said, “indicating that the on-chain movement of old coins has stopped and new demand is driving supply.” The VDD multiple rises when there is relatively strong selling by long-term holders and falls when investors switch to holding (HODLing).

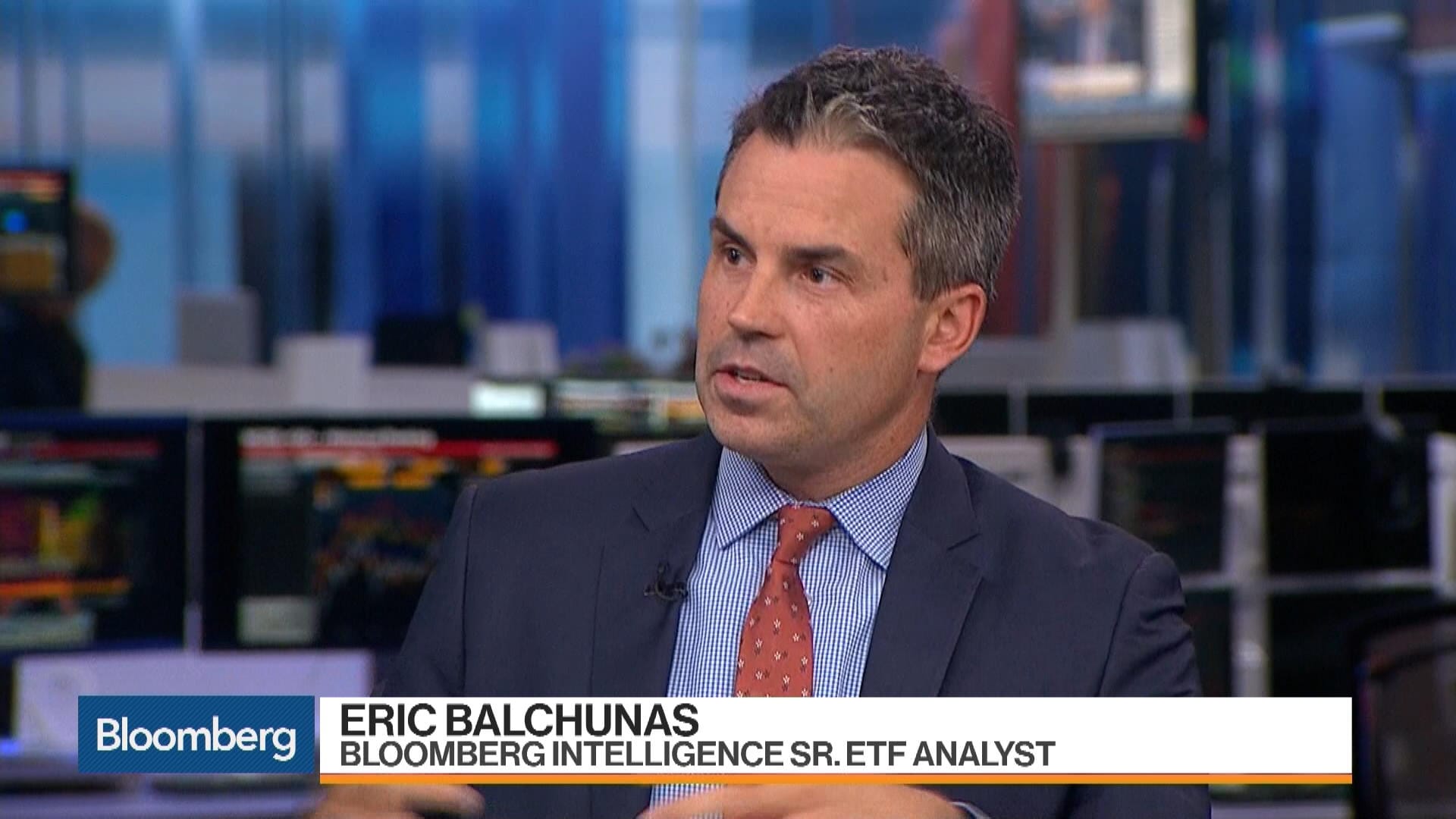

Meanwhile, as Bloomberg ETF analyst Eric Balchunas told X, “More than 95% of Bitcoin ETF investors haven't sold despite the market downturn. We don't know if this will happen again. But analyzing historical data shows that it can and likely will happen again. As I said before, when there are outflows, there are inflows.”