Bitcoin has fallen hard. What are analysts analyzing?

“Cryptocurrency traders are keeping a close eye on the June FOMC meeting, with price action likely to be driven by market expectations of a rate cut,” said crypto research firm K33 Research. The FOMC is scheduled to release the US May CPI at 21:30 on December 12 and the US interest rate decision at 3:00 on December 13. "The streak of net inflows into BTC spot ETFs has ended, and traders on the Chicago Mercantile Exchange (CME) are looking to reduce risk. Long squeeze (selling to close or cover long positions) ahead of the CPI-rate announcement may also be seen outside the US. Ethereum (ETH) is likely to see a bullish rally this summer in anticipation of spot ETF approval."

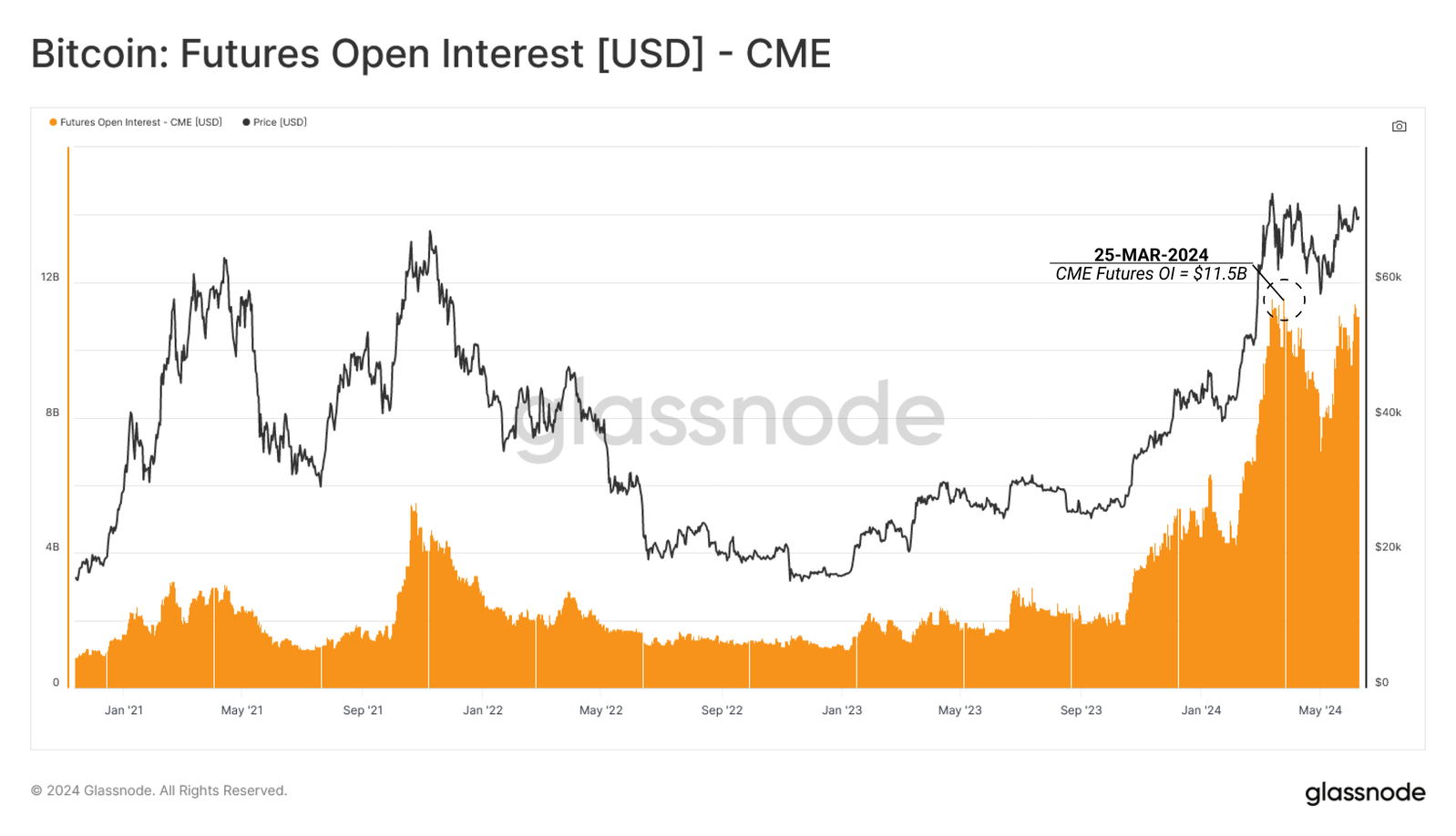

Another analyst, Glassnode, said, “The price rally is also being impacted by traders adopting a cash-and-carry strategy of buying Bitcoin via spot ETFs and shorting it via Chicago Mercantile Exchange (CME) futures. "In particular, hedge funds have a combined short position of $6.3 billion in BTC ($97 million on CME alone), effectively nullifying inflows into spot ETFs. Nevertheless, the volume of BTC flowing into large institutions is growing daily, along with ETF trading volume."

Meanwhile, crypto analyst MartyParty, who has nearly 90,000 followers on X, wrote on X: “Bitcoin has now approached or broken $70,000 13 times since March 12th. Each time it tested the highs, a sell wall appeared on Binance, which disappeared as the price fell. Binance may be suppressing BTC price through its order book,” he said.

Seth (@Seth_fin), a crypto analyst with 50.1k followers, commented: “Binance is the largest exchange in the world. I'm sure there's price manipulation in the soy bean market, but I don't see why a few whales would be pushing the BTC price down."