Bitcoin trades sideways despite Nasdaq gains, Ethereum ETF approval unlikely in May

Bitcoin is trading sideways at $66,000. At the time of writing, bitcoin was trading at $651,513.67 (average price on major exchanges), down 0.5% from the previous day, according to cryptocurrency statistics site CoinGecko. Ethereum is also up 0.2% to $3219.45, while Binance Coin is down 0.4% to $604.67. Elsewhere, Solana was down -1.9%, Ripple -2.6%, Ada -3.2%, Toncoin -4.1%, Dogecoin -1.0%, Sivainu -0.7%, Avalanche -2.5%, Polkadot -3.5%, Tron +0.8%, Uniswap -2.9%, Polygon +1.5%, Litecoin -0.7%, Aptos -4.7%, Cosmos -3.1%, and OKB +0.1%.

U.S. stocks rose on expectations of strong earnings a day ahead of big tech earnings season. The Dow Jones Industrial Average closed at 38,503.69, up 263.71 points, or 0.69%, from the previous trading day. The S&P 500 was up 59.95 points, or 1.2%, at 5070.55, while the tech-heavy Nasdaq Composite was up 245.33 points, or 1.59%, at 15,696.64.

The crypto market recovered amidst macro issues, but was weighed down by analysts who said the chances of an ethereum exchange-traded fund (ETF) being approved have diminished. According to foreign media, the U.S. Securities and Exchange Commission (SEC) has repeatedly delayed its decision on whether to approve Franklin Templeton and Grayscale's ETH spot ETF. The SEC also announced that it is seeking public feedback on BlackRock's proposed amendment to its ETH spot ETF. Earlier this year, the SEC delayed a decision on BlackRock's ETH spot ETF, and on Sept. 19 (local time), Nasdaq filed an amendment to the proposal, which included changes to the ETF's redemptions. Public feedback will be open for the next 21 days. Industry observers had expected a May approval to be difficult given the SEC's conservative approach to treating ETH as a security.

“We were and remain pessimistic about approval,” said Eric Balchunas, ETF analyst at Bloomberg, “as issuers are making moves to get the SEC's attention, such as filing amendments for an Ethereum spot ETF and an S-3 for an Ethereum Trust (ETHE), but it appears to be largely in vain.” Standard Chartered also analyzed in its report that an Ethereum spot ETF is unlikely to be approved in May. “Inflows into bitcoin spot ETFs have slowed recently, and we think it is unlikely that an ethereum spot ETF will be approved in May,” Standard Chartered said. “That said, the crypto market has endured several weeks of headwinds and the worst is over. The market is now poised for a recovery. Our year-end price target for Bitcoin remains $150,000, while our price target for Ethereum is $8,000.”

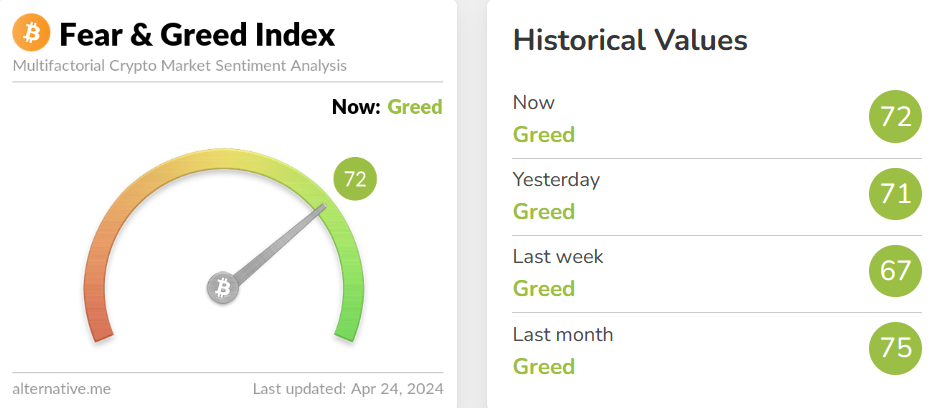

Meanwhile, investor sentiment indicators remain in a “greedy” state. Cryptocurrency data provider Alternative's self-estimated “Fear-Greed Index” rose one point from the previous day to 72, indicating greed. The index indicates extreme fear in the market when it is close to zero, and extreme optimism when it is close to 100. The Fear-Greed Index is calculated based on volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin market capitalization (10%), and Google searches (10%).