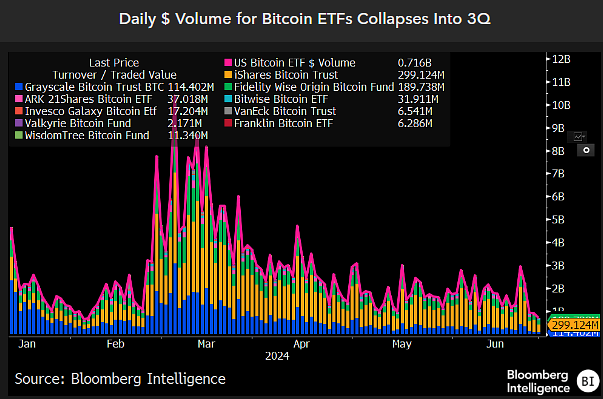

Bitcoin spot ETF trading volume is down, but 50% of the top 25 U.S. hedge funds hold BTC ETFs.

Bloomberg ETF analyst James Seyffart tweeted on his X (formerly Twitter), "Trading volume in the U.S. Bitcoin spot ETF group is clearly declining. It hasn't hit $3 billion a day since mid-May," he wrote. He continued, "US Bitcoin spot ETF fund flows are stagnant. There are neither large inflows nor outflows. However, the cumulative net inflows since launch are healthy at around $14.7 billion." In addition, more than 50% of major U.S. hedge funds have exposure to Bitcoin, according to data from Bitcoin custodian River. According to the data, 13 of the top 25 U.S. hedge funds held Bitcoin ETFs at the end of the first quarter of 2024, with global asset manager Millennium Management holding 27,263 BTC (about $16.9 billion), or 2.5% of its $67.7 billion in total assets under management.