Bitcoin breaks $6.4K on massive short bet liquidation

On October 14, 2024, Bitcoin (BTC) surged 2.5% to surpass the $64,000 mark due to massive liquidations in the Bitcoin futures market. According to data from on-chain analytics platform Glassnode, the Bitcoin surge on the afternoon of October 14 resulted in the liquidation of approximately $2.5 billion in outstanding interest. Glassnod noted that most of the liquidations came from short-betting investors, as the Bitcoin surge led to mass liquidations in the futures market, which in turn caused Bitcoin to surge further. According to Glassnode's data, about $2.5 billion worth of futures open interest was forced to liquidate during the Bitcoin price rally, likely wiping out many short sellers.

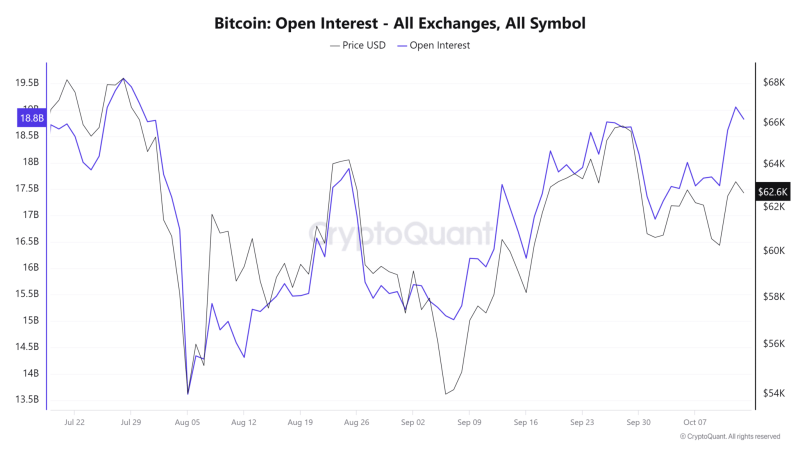

Data from CryptoQuant, a South Korean on-chain data analytics firm, characterizes the mass liquidation that occurred in the futures market as an “explosion.” According to CryptoQuant, open interest soared from about $17.5 billion on Oct. 10 to $18 billion on Oct. 14. Meanwhile, Bitcoin's surge and subsequent mass liquidation has sparked bullish expectations in and around the market, with Bitcoin up 2.5% in one day. “The bus is leaving when the bus gets off,” cryptocurrency CEO Ki-Young Ju wrote on his X account on Thursday.