$160 million liquidated in 24 hours... Bitcoin and Ether long dominance in 4-hour period... Ripple and Dogecoin short dominance

A total of $161.07 million was liquidated in the global cryptocurrency market over a 24-hour period. A total of 65,679 traders were affected by the liquidation. The largest single liquidation was $8.21 million for BTC-USDT on Binance. According to data compiled by CoinGlas, Bitcoin (BTC) recorded the largest liquidation at approximately $38.16 million in 24 hours, followed by Ethereum (ETH) at approximately $29.48 million. In addition, a total of $26.46 million in liquidations occurred in △Ripple (XRP) $6.76 million △Dogecoin (DOGE) $5.94 million △other coins.

By exchange, Binance accounted for about 42% of the total, with about $67.88 million in liquidations. OKX was ranked second and third with approximately $43.67 million and approximately $26.04 million, respectively. In addition, Gate.io liquidated $11.29 million, HTX $8.81 million, and CoinEx $2.66 million.

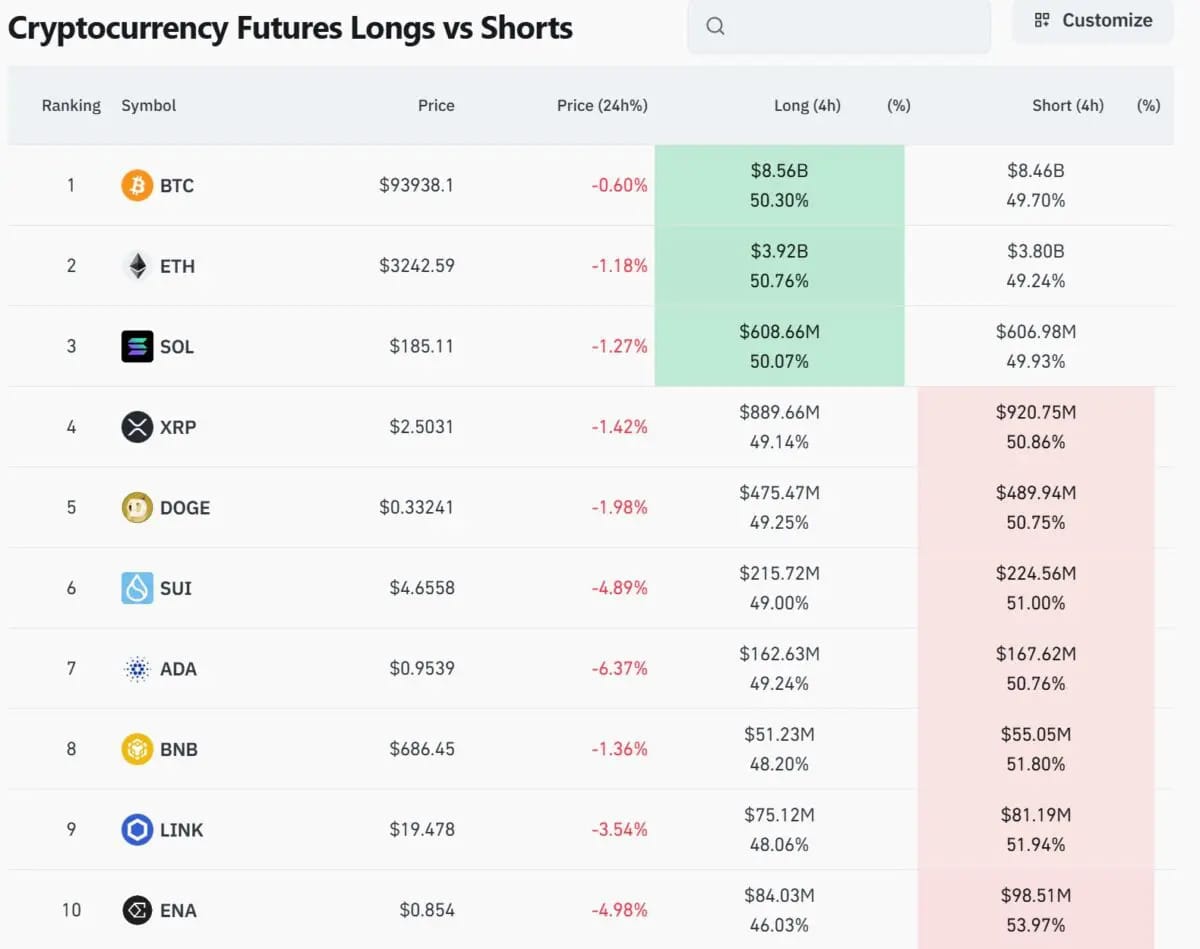

Although the total size of the liquidation has decreased compared to the previous trading day, investor sentiment appears to be shrinking. Looking at the long-short ratio in the four-hour futures market, the short-side was dominant for most coins except for Bitcoin and Ethereum. When looking at the position share of the entire cryptocurrency futures market over a four-hour period, Bitcoin's long position share was 50.30%, slightly ahead of the short position share (49.70%). Ethereum also had a long position of 50.76%, which was higher than the short position (49.24%). On the other hand, Ripple's short position accounted for 50.86%, outnumbering long positions (49.14%), and Dogecoin's short position also accounted for 50.75%, outperforming long positions (49.25%). The short position size of Dogecoin was approximately $489.94 million, and the long position was approximately $475.47 million.

In SOL and ADA, the ratio of long to short positions was almost equal. Solana recorded a long-term ratio of 50.07% and a short-term ratio of 49.93%, while Cardano showed a slight difference with a long-term ratio of 49.24% and a short-term ratio of 50.76%. The proportion of short positions was high for small-sized coins, and in particular, ENA's short position was 53.97%, which was much higher than the long position (46.03%). The long-short ratio is an important indicator that reflects the market sentiment and shows how investors are judging the current market direction.